With a HELOC, you'll get access to a credit line secured by your home equity. HELOC lending institutions typically charge variable rate of interest, however you can tap into the credit (and pay it back) consistently as needed. For both home equity loans and HELOCs, customers can usually borrow as much as 80-90% of the value of their home. Sandra Hamberg is a house owner who just recently completed a few house additions, including a recreation room and remodeling her kitchen with brand-new devices and cabinets. She states, "We selected a home equity loan for our funding due to the low-interest rate and the wish to have the ability to write off the interest on our taxes." When you're obtaining against your home's equity, lenders will have standards in location for just how much they want to provide.

Additionally, lending institutions will vary in how much they will charge you to borrow the cash and how long you need to repay it - Which of these arguments might be used by someone who supports strict campaign finance laws?. For that reason, you'll desire to look around to review and compare what various lending institutions will offer you and to discover the very best suitable for your scenario. Another option is a cash-out refinance. With this route, you'll secure a new, bigger loan, through which you'll settle both your existing mortgage and your new addition. Preferably, look for a new loan with more desirable terms than your initial mortgage. What are the advantages of the cash-out refinance? It lets you manage all your payments in a single mortgage, and it can possibly provide lower interest than home equity loans.

The loan will be secured by your home, so if you stop working to make your payments, you could lose your home. You will likewise have to pay for processing costs. Last but not least, a brand-new kind of equity funding has emerged. Equity financing companies like Spot Residences deal house equity financing without any interest or regular monthly payments. All they ask is an up-front fee, and a portion of the distinction in the worth of your home after a concurred upon the span of time. Let's look at an example. Let's state your home deserved $500,000 before the addition, and you accepted pay 25% of the house's appreciation or depreciation after ten years.

The benefits of this choice are apparent. You'll get the money you need to redesign your home, without having to stress over valuing financial obligation or keeping up with month-to-month payments. However, you will need to pay an in advance charge. And depending upon just how much the worth of your house modifications, you might end up paying a good offer more than you would have with a standard loan.Credit cards are another kind of unsecured funding you can think about. Similar to individual loans, your credit report will identify your approval. Typically, credit cards feature greater interest rates than individual loans, making them a less preferable option.

If you felt great that you might pay off your balance before the duration was up, you might get the cash you required without paying a cent of interest. What's the catch? If you stop working to pay off your financial obligation prior to the introductory period ends, your interest will rocket up. Another method is to combine funding methods. For example, you might use your interest-free charge card through completion of the initial period, and then use an individual loan to pay off your remaining balance. You'll avoid the charge card increased rates of interest, and will have a much smaller sized read more balance in your loan to pay interest on.

7 Simple Techniques For How To Owner Finance A Home

And if you max out your charge card, it will injure your credit utilization ratio. Until you pay off 70% of the quantity obtained, this will likewise harm your credit report. When the federal government insures loans, it decreases the risk for loan providers. This makes it more Click here to find out more most likely that they will provide to you. If you have bad credit and are having a hard time to get approved through other avenues, have a look at these programs. 203( k) insured loans are comparable in structure to cash-out refinance loans. They aim to streamline the process of making repairs or renovations to a home. The U.S. Dept. of Housing and Urban Advancement (HUD) program insures single-close long-term mortgages with either fixed or variable interest rates.

Title 1 loans resemble individual loans. They are house and residential or commercial property enhancement loans offered by approved Title 1 Lenders and guaranteed by HUD. What happened to household finance corporation.Making an addition to your home is a big job that will take time, patience, and capital. But in the end, you can delight in the renovations that made your home exactly as you want it to be. Your very first action is to investigate your alternatives and discover what you receive. Need assistance? Have a look at Super, Money's loan engine to get personalized deals in a matter of minutes.Jessica Walrack is an individual financing writer at Super, Money, The Simple Dollar, Interest. org and lots of others.

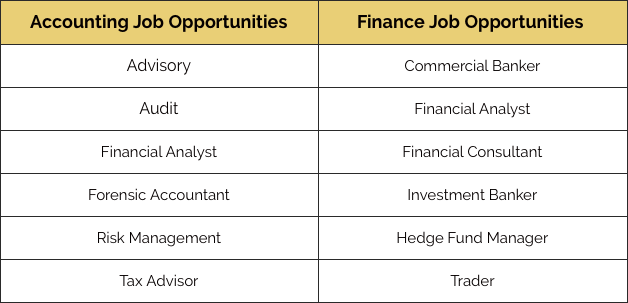

She concentrates on taking individual financing topics like loans, credit cards, and budgeting, and making them accessible and fun - What jobs can i get with a finance degree.

Building an addition to your house can develop value, however can also cost thousands of dollars. If you require funding for an addition, individual loans and home equity loans can be beneficial options.

Yes, you can get a loan for a house addition. Individual loans are available for all types of credit and can be utilized for home addition financing. Although rates might be higher compared to protected loans, the majority of individual loans don't need any collateral. Personal loans are frequently much easier to secure and tend to be less dangerous than comparable choices. Individual loans are a leading option for home addition funding. In addition to being less risky and requiring no collateral, individual loans provide many pros. Comparing lending institutions is necessary if you choose to use a personal loan. Probably, lots of lenders will be completing to secure your loan.

How To Fight Lease Finance Group Can Be Fun For Anyone

Acorn Financing is a safe and secure platform that makes getting competitive offers from numerous lenders simple. Basic application and approval procedure No security needed Fixed rate of interest for the period of the loan (in most cases) Competitive interest rates Obtain practically any quantity (generally in between $1,500 $100,000) Generous quantity of time allowed to repay loan Quick funding Rate of interest may be somewhat higher than similar options Credit history needed most of the times Fixed payments Numerous personal loans have origination costs Some personal loans come with prepayment charges Developing a space or house addition costs approximately $44,805. Reports show that the majority of homeowners invest between $21,003 and $68,606.

Usually it costs around $48,000 to include a 2020 family room. Home addition funding can supply an affordable service that can help increase the value of your house. Most most likely you can recoup interest expenditures associated with the loan when you offer your house. Adding a bathroom or bedroom can be significantly cheaper than adding a 2020 room. Typically, it costs about $17,300 to add a 1212 bed room. Adding a bathroom normally starts around $18,000. can you get out of a timeshare In many cases, adding a bedroom to your house will increase the value and desirability. Every residential or commercial property must be examined on a specific basis by a professional to identify the specific worth.